How to Send Money from Japan to the US, Canada, or the EU: The Trusted, Low-Fee Way

The following article sources readily available information and was published on May 27th, 2025 JST.

Sending money abroad from Japan — whether to the US, Canada, or Europe — has historically been expensive, slow, and inconvenient. If you’re a student, freelancer, expat, or business owner, you’ve likely faced:

High fixed fees from banks (¥3,000 - ¥5,500 per transaction)

Unfavorable, opaque currency exchange rates

Long wait times for the money to arrive

Language barriers when using JP-based services

Thankfully, there’s a globally trusted and Japan-licensed solution that makes international transfers simple and low-cost: Wise.

Why Traditional Transfers Still Frustrate Japan-Based Users

Even in 2024, major Japanese banks such as MUFG, SMBC, and Mizuho charge:

¥3,000 - ¥5,500 per transfer fee

An FX margin of 2 - 4% on top of interbank exchange rates

Extra fees for intermediary or receiving banks (especially SWIFT-based payments)

Example fees (in Japanese only):

https://www.bk.mufg.jp/tesuuryou/gaitame.html

https://www.mizuhobank.co.jp/tetsuduki/gaikoku_soukin/index.html

Why Wise is a Better Alternative

Wise is a London-based fintech company that is officially registered in Japan under “Wise Payments Japan K.K.” and supervised by the Kanto Local Finance Bureau.

Features:

Mid-market exchange rate — no hidden markup

Transparent, low fixed fees (from ~¥200 - ¥1,200 depending on country and amount)

Real-time tracking and notifications

Fully translated UI for Japanese users

Trusted by over 16 million users globally

How to Send Money with Wise: Step-by-Step Guide

Create a free account at Wise.com or through the mobile app

Verify your identity by submitting:

My Number (個人番号)

Passport or Residence Card

Address in Japan

Enter recipient bank details (US, Canada, or EU account — local or SWIFT-based)

Input the transfer amount — Wise will show:

The exact fee

The current FX rate

Estimated arrival time

Choose your payment method:

Bank transfer (furikomi)

Debit card

Credit card

Confirm and track your transfer in real time

Watch the videos below for more in-depth instructions

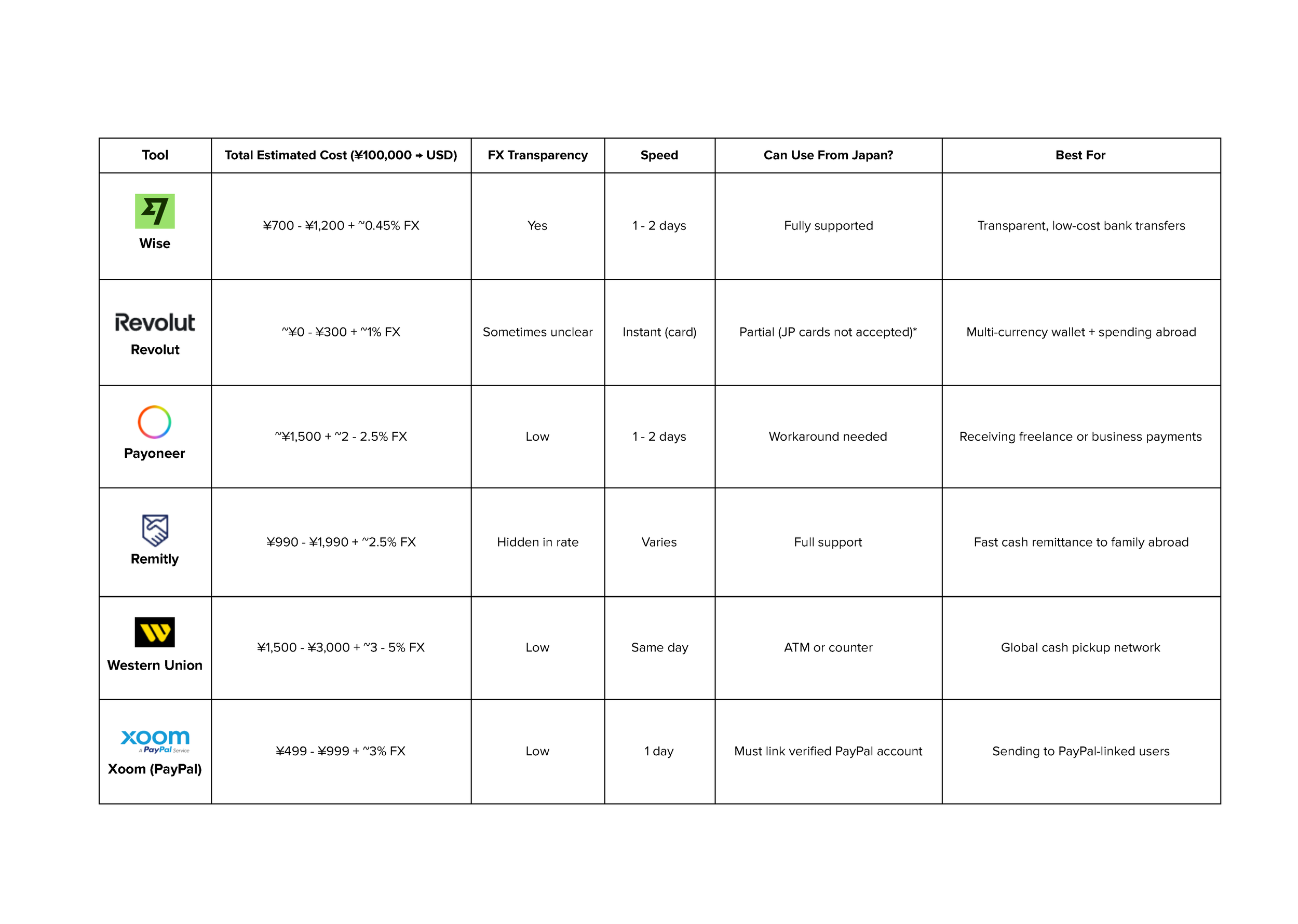

Transfer Comparison Table

As of May 27th, 2025 @ 14:47 JST

How About Sending to Canada or the EU?

Wise supports local transfers in CAD and EUR, with most major bank networks supported:

Canada: Supports direct deposits to Canadian institutions including RBC, TD, and Scotiabank

EU: Uses SEPA for fast euro transfers to countries like Germany, France, Netherlands

Currencies supported: Over 50 including JPY, USD, CAD, EUR, GBP, AUD, SGD

*Revolut currently does not fully support Japan-issued debit/credit cards for topping up, and the local transfer setup is limited — users in Japan can hold JPY but may need to use a non-Japanese top-up method.

All of the above platforms/tools require photo ID and some form of address verification. Wise requires your My Number Card, but this is standard for legal remittance providers in Japan.

Overall: For outbound money transfer from Japan, Wise is generally cheaper and faster in most cases.

What About Expats Living in Japan?

If you're a foreign resident living in Japan, yes — you can still use Wise to send money abroad, as long as you meet a few basic conditions.

In Japan, as of May 2025, everyone with a medium- or long-term visa (more than 3 months) is issued a My Number (個人番号) after registering their address at a local municipal office. This includes:

International students

Skilled foreign workers

Spouses and dependents

Permanent residents and long-term visa holders

You’ll receive your My Number via mail after your residence registration is complete. You do not need to be a Japanese citizen.

To use Wise from Japan, you will need one of or all of the following:

Your My Number (notification letter or official card)

Your residence card (在留カード)

A registered Japanese address

If you're a short-term visitor or tourist, you won’t receive a My Number and therefore cannot register with Wise Japan. You could, however, register with Wise from your home country, request a Wise debit card, and withdraw cash locally in Japan. Another article covering how money can be sent to Japan will be posted in the near future.

As such, Wise also supports users globally. If you move away from Japan, you can update your Wise profile and continue using it from other countries.

How about About 7-Bank (Seven Bank) ATM Transfers?

Another method available in Japan is the Seven Bank International Money Transfer Service, offered through 7-Eleven ATMs and a mobile app.

How it works:

You register once through their app or online

After registration, you can send money abroad via any 7-Eleven ATM

Funds are typically picked up in cash by the recipient (via Western Union)

Some countries may support direct bank deposit

Pros:

Convenient for people who prefer cash

Available 24/7 through 7-Eleven ATMs

Japanese language support

Cons:

FX margins are not clearly shown upfront

Often higher overall cost than Wise for larger transfers

Cash-based pickup not ideal for US/Canada/EU transfers where bank deposits are preferred

Typical Fee (as of 2024):

¥990 - ¥2,000 fixed fee + currency exchange margin

Limits and fees vary by country and payout method

Best for:

Sending money to countries where recipients don’t have a bank account

Emergency cash remittances

Not ideal for:

Professionals, freelancers, or family transfers to US, Canada, or EU bank accounts

Frequently Asked Questions

Do I need My Number?

Yes. As per Japan’s “Act on Prevention of Transfer of Criminal Proceeds,” My Number and ID verification are required for sending from Japan using financial services like Wise.

Can I send in JPY and the recipient gets USD/EUR/CAD?

Yes. Wise automatically converts your yen at the real mid-market rate and shows all charges before you pay.

Are there any transfer limits?

Yes. New users are usually limited to about ¥1 million/day. With account verification, you could possibly send more.

Is Wise safe?

Yes. It is supervised by the Kanto Finance Bureau, complies with local laws in Japan, and is used by over 16 million people worldwide.

Conclusion: Why Wise is Worth Using

Wise offers a transparent, regulated, and cost-efficient solution for sending money internationally from Japan to North America and Europe. It’s far easier to use, faster, and often over 60% cheaper than traditional banks.

Ready to transfer money the smart way?

Click here to open a free Wise account in Japan.